- Moneywiz 2 2 1 Download Free Hidden Object Games

- Moneywiz 2 2 1 Download Free Utorrent

- Moneywiz 4

- Moneywiz 2 For Windows

- Moneywiz Download

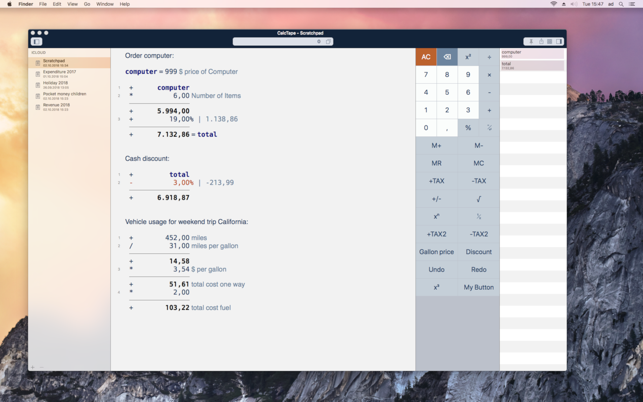

Download Now Secure Download. 3 months free with 1-year plan. MoneyWiz 1.5 2011-03-21 22:01:53 By jasonanselmo Pros. Very nice interface. This makes MoneyWiz 2 my pick over MoneyWiz 3. I did accidentally load MoneyWiz 3 on my new Mac and ended up locking up my data. A quick e-mail to their support team restored my data for use with MoneyWiz 2 in a very short time (less than an hour). Their support team is responsive and pleasant to work with. MoneyWiz 2 is a budget app that is packed with so much more. You can also access your online banking accounts and see your bills within MoneyWiz 2 as well. Aug 17 2020: Open vSwitch 2.14.0 Available; Aug 05 2020: 2.13.1, 2.12.1, 2.11.4, 2.10.5, 2.9.7, 2.8.9, 2.7.11, 2.6.8 and 2.5.10 Available; Sep 12 2019: Registration.

Google Play Rating history and histogram

Changelog

No changelog data

Developer information

Pleasant Hill, CA

USA

Description

Simplify your financial life with MoneyWiz.Have all your accounts, budgets and bills in one place! With powerful reports, worldwide online banking and instant sync between all your devices! That's MoneyWiz - the world's most powerful and beautiful finance software.

MoneyWiz has been featured by Forbes, MacWorld, The Telegraph, The Independent, Mashable, TUAW, Cult of Mac and more.

HOW CAN MONEYWIZ HELP YOU?

● ALL IN ONE PLACE : Have all your finance data in one place, for a unique overview and easy management!

● GET OUT OF DEBT : We've built MoneyWiz in a way that makes it easy to see the complete picture of your finances, yet be able to narrow down where they can be optimized so you can get out of your debt!

● NEVER FORGET A BILL AGAIN : Forgetting to pay a bill can cost you. MoneyWiz will make sure that never happens again. Set up all your bills to get reminders and forecasting.

● PROPER FORECASTING : Have you wondered how much more you have to pay until the next paycheck, or which accounts may not have sufficient funds for your bills? MoneyWiz will tell you with a tap of a button!

FEATURES HIGHLIGHT

● ACCOUNTS: Have all your accounts in one place. Arrange them in groups, give them icons and decide which accounts count towards your Net Worth. Choose from variety of accounts: Credit Card, Checking, Savings, Loan, Cash or Online Banking.

● BUDGETS: Set up budgets and MoneyWiz will automatically monitor your transactions and assign them to the proper budgets. Envelope budgeting is also available.

● BILLS: Never forget a bill again! Browse all your bills in list or on calendar, see projections for any period with a single tap.

● WORLDWIDE ONLINE BANKING: Connect your online banking into MoneyWiz, and all transactions will be downloaded and categorized automatically. MoneyWiz will even set the proper payee! (* optional service, requires subscription)

● TRANSACTIONS ENTRY: Entering transactions has never been so powerful! Customize what fields you want to use, configure settings for each field, use the pull-down gesture to save a transaction. It makes transaction entry as fast as it can be!

● REPORTS: Tons of reports will give you a perspective on your spendings and earnings, that you never had before! MoneyWiz also allows you to build custom reports based on what you want to know about your money.

● DASHBOARD: The dashboard is the one place to get a quick overview of your finances. Fill it with multiple widgets which you can re-arrange and configure. See everything important in one screen.

● SETTINGS: Configure MoneyWiz to fit your needs. Enable currencies, manage categories, set layout of the transactions list, enable POS style amounts entry, configure bill reminders and so much more.

● PROTECTION: Protect your data with PIN. Set PIN timeout for maximum comfort and auto-erase on 10 times wrong PIN for maximum security. iOS version also offers TouchID integration for devices that support it.

● SYNC: Connect multiple devices with SYNCbits – the cloud sync that does everything automatically – from sync, to conflicts resolution. SYNCbits has banks level security and it's completely free!

● IMPORT: Coming from another software? MoneyWiz can import it! Be it a CSV, QIF, OFX, QFX or MT940 file, MoneyWiz can handle it all.

SUBSCRIPTION & PRIVACY NOTICE

To connect to your bank, MoneyWiz requires the in-app Online Banking paid subscription. The subscription costs $4.99 per month, or $49.99 per year.

MoneyWiz is integrated with 3rd party data aggregators to provide the Online Banking feature.

Recent changes:

Bug fixes

Have all your accounts, budgets and bills in one place! With powerful reports, worldwide online banking and instant sync between all your devices! That's MoneyWiz - the world's most powerful and beautiful finance software.

MoneyWiz has been featured by Forbes, MacWorld, The Telegraph, The Independent, Mashable, TUAW, Cult of Mac and more.

HOW CAN MONEYWIZ HELP YOU?

● ALL IN ONE PLACE : Have all your finance data in one place, for a unique overview and easy management!

● GET OUT OF DEBT : We've built MoneyWiz in a way that makes it easy to see the complete picture of your finances, yet be able to narrow down where they can be optimized so you can get out of your debt!

● NEVER FORGET A BILL AGAIN : Forgetting to pay a bill can cost you. MoneyWiz will make sure that never happens again. Set up all your bills to get reminders and forecasting.

● PROPER FORECASTING : Have you wondered how much more you have to pay until the next paycheck, or which accounts may not have sufficient funds for your bills? MoneyWiz will tell you with a tap of a button!

FEATURES HIGHLIGHT

● ACCOUNTS: Have all your accounts in one place. Arrange them in groups, give them icons and decide which accounts count towards your Net Worth. Choose from variety of accounts: Credit Card, Checking, Savings, Loan, Cash or Online Banking.

● BUDGETS: Set up budgets and MoneyWiz will automatically monitor your transactions and assign them to the proper budgets. Envelope budgeting is also available.

● BILLS: Never forget a bill again! Browse all your bills in list or on calendar, see projections for any period with a single tap.

● WORLDWIDE ONLINE BANKING: Connect your online banking into MoneyWiz, and all transactions will be downloaded and categorized automatically. MoneyWiz will even set the proper payee! (* optional service, requires subscription)

● TRANSACTIONS ENTRY: Entering transactions has never been so powerful! Customize what fields you want to use, configure settings for each field, use the pull-down gesture to save a transaction. It makes transaction entry as fast as it can be!

● REPORTS: Tons of reports will give you a perspective on your spendings and earnings, that you never had before! MoneyWiz also allows you to build custom reports based on what you want to know about your money.

● DASHBOARD: The dashboard is the one place to get a quick overview of your finances. Fill it with multiple widgets which you can re-arrange and configure. See everything important in one screen.

● SETTINGS: Configure MoneyWiz to fit your needs. Enable currencies, manage categories, set layout of the transactions list, enable POS style amounts entry, configure bill reminders and so much more.

● PROTECTION: Protect your data with PIN. Set PIN timeout for maximum comfort and auto-erase on 10 times wrong PIN for maximum security. iOS version also offers TouchID integration for devices that support it.

● SYNC: Connect multiple devices with SYNCbits – the cloud sync that does everything automatically – from sync, to conflicts resolution. SYNCbits has banks level security and it's completely free!

● IMPORT: Coming from another software? MoneyWiz can import it! Be it a CSV, QIF, OFX, QFX or MT940 file, MoneyWiz can handle it all.

SUBSCRIPTION & PRIVACY NOTICE

To connect to your bank, MoneyWiz requires the in-app Online Banking paid subscription. The subscription costs $4.99 per month, or $49.99 per year.

MoneyWiz is integrated with 3rd party data aggregators to provide the Online Banking feature.

Recent changes:

Bug fixes

Moneywiz 2 2 1 Download Free Hidden Object Games

Hide full descriptionComments

We don't have enough comments to generate tag clouds.Please check back later.

Google Play Rankings

Permissions

Libraries

Moneywiz 2 2 1 Download Free Utorrent

Related apps

Moneywiz 4

More fromSILVERWIZ LLC

Moneywiz 2 For Windows

Freezero 1.7 DOWNLOAD

Moneywiz Download

The loss may or may not be financial, but it must be reducible to financial terms, and usually involves something in which the insured has an insurable interest established by ownership, possession, or pre-existing relationship.

The insured receives a contract, called the insurance policy, which details the conditions and circumstances under which the insurer will compensate the insured. The amount of money charged by the insurer to the policyholder for the coverage set forth in the insurance policy is called the premium.

If the insured experiences a loss which is potentially covered by the insurance policy, the insured submits a claim to the insurer for processing by a claims adjuster. The insurer may hedge its own risk by taking out reinsurance, whereby another insurance company agrees to carry some of the risks, especially if the primary insurer deems the risk too large for it to carry.

Methods for transferring or distributing risk were practiced by Chinese and Babylonian traders as long ago as the 3rd and 2nd millennia BC, respectively.[1] Chinese merchants travelling treacherous river rapids would redistribute their wares across many vessels to limit the loss due to any single vessel's capsizing.

The Babylonians developed a system which was recorded in the famous Code of Hammurabi, c. 1750 BC, and practiced by early Mediterranean sailing merchants. If a merchant received a loan to fund his shipment, he would pay the lender an additional sum in exchange for the lender's guarantee to cancel the loan should the shipment be stolen, or lost at sea.